It has been some time since you parted ways with ACEA and so did the Stellantis. There is a common pitch in the two OEM in your claim that the association was not defending your interests. Is it expectable that the two manufacturers will join efforts to create an organisation you feel defends your interests?

Jim Rowan- When we left ACEA it was because we wanted to go in one direction and we did not feel they were pushing in the same way: simply put, we want to be fully electric by 2030 and ACEA is aiming for 2035 and this implies different steps in different moments. There was no fallout, we are still available to cooperate in specific issues we think make sense for the whole industry like charge infrastructure and certain standards, for instance. But we have no intention to set up another parallel association at this point in time.

Even though you have recently shown some concern about how slow your competitors are adopting the necessary measures for the electric conversion? And now also the legislators showing some willingness to accept slowing down the process?

JR- Even though we have a faster pace towards full electric, some of those companies are already producing EV and then you look at things as charging standards and it makes absolute sense for all of us to get on the same boat for the common interest (both of the industry and the customers). There is no sense in setting different charging networks whether it is DCS or Ionity. We had an agreement with Tesla, in the USA, to use their chargers and I believe that should be an example to follow in Europe and other regions as well.

Do you see a different speed in transformation between the Chinese in the industry and the European towards electrification?

JR- When you look at the process from a global perspective, indeed we see three different pictures. In the USA we have the West Coast (mostly but also the East) electrifying at a good pace fomented by the Inflation Reduction Act (which I applaud for promoting Green Energy and overall climate protection measures). The interior is falling behind, even if it will be helped by Electrify America effort. In Europe, the north is also moving fast, southern Europe is slower. In both cases it is an advantage for Volvo which offers PHEV and MHEV vehicles versus a pure EV player which cannot get a grasp of the whole market now. And China, although its bigger, is also doing a big effort which comes from the part that the hundreds of huge cities play in this process.

You have announced the last diesel engine will be produced in early 2024… what about PHEV… are you not investing in them anymore?

JR- We now only have testing facilities in our R&D centres globally but we are not investing on that technology. We did what we could in the XC60 PHEV/XC90 PHEV to provide more range, using the same space and platform layout but adding range with a battery with higher energy density and also improved power electronics.

It´s an awkward idea that in six years you will only assemble electric cars…

JR- Not really. The company that is number one in EV sales globally has been doing this for years and they sell a lot of cars. It´s not like we are going to step on thin ice when we get there. They are the market leaders in terms of sales and the most successful car manufacturer in terms of market capitalization by far. So that is the proof point that you can be a purely electric car brand already today and be highly successful.

MPVs have come and gone but now you surprise the world with an electric MPV. Could it work in markets outside China where you have developed and where you are launching it?

JR- We don’t know exactly if the demand will be there in some years in other regions. 20 years ago no one anticipated how successful SUV were going to be. In China it does make sense because there is a lot of intergenerational activities going on during weekends: you get the mother, the father, the grandparents, the kids, all going somewhere and looking for comfort and a premium travel experience. So there we are with the EM90 which plays perfectly into our safety narrative.

You will be close to 700 000 units sales in 2023 which will technically match your all-time highest sales volume (in 2019, 705 000). You will add the EX90 and the EX30 in the next months… does that mean one million new Volvo on the road in one year is just around the corner?

JR- At the IPO we said we would be at around 1.2 million/year by mid-decade and we are well on track. We have been very choiceful in the way we are electrifying our portfolio and that is helping us. People need a compact SUV like in the EX30 and in that segment a 480 km range is absolutely fine… and even less than that if you are going to use less expensive LFP batteries to lower the vehicle price. That was some white space to open up and bring in new customers and new sales. Same thing about the EX90 regarding new customers coming in.

Everybody is weary about the challenges the EV strategy adoption brings. Can you sheer everyone up with a more positive view about the most important automotive revolution in 100 years?

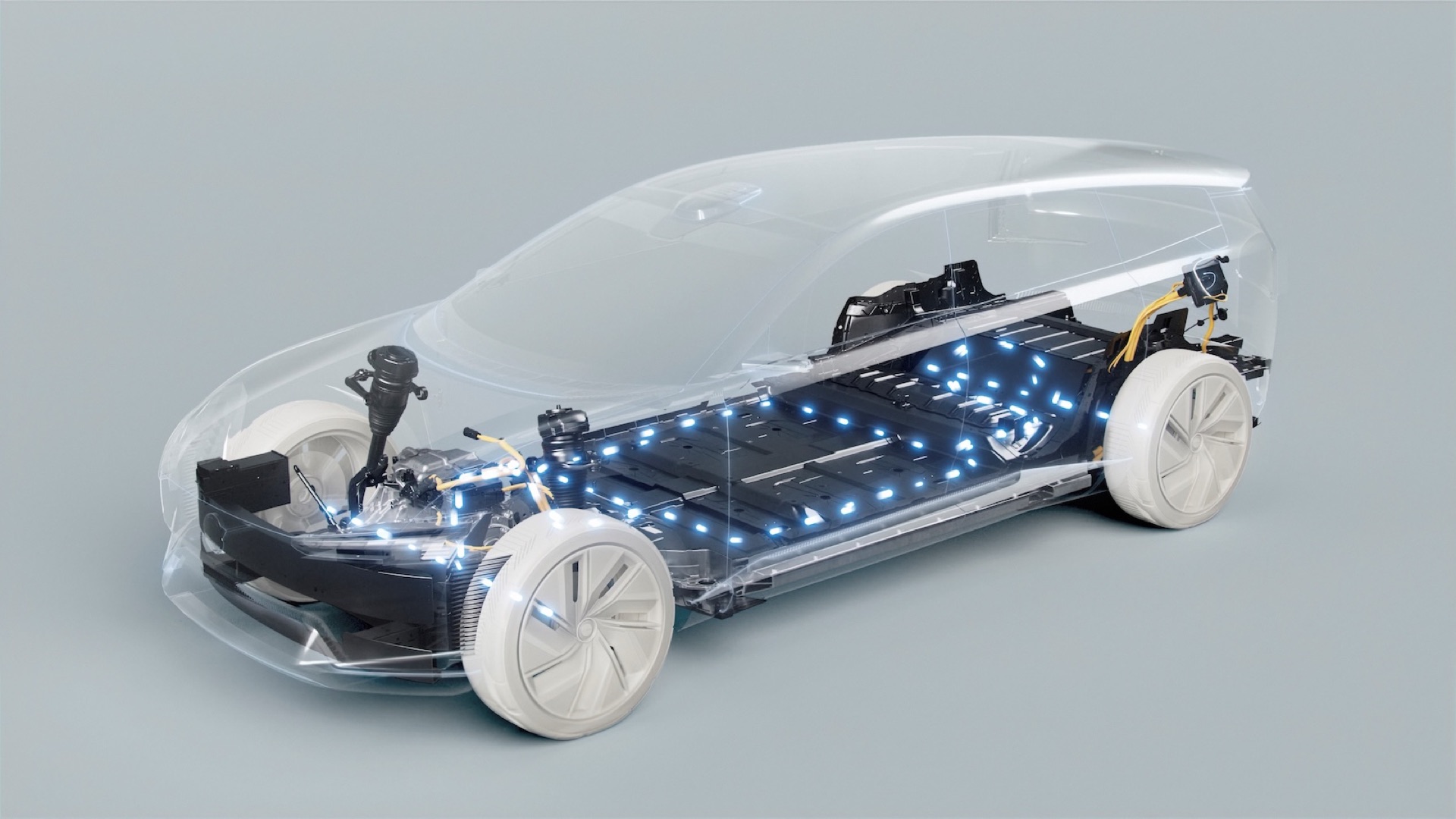

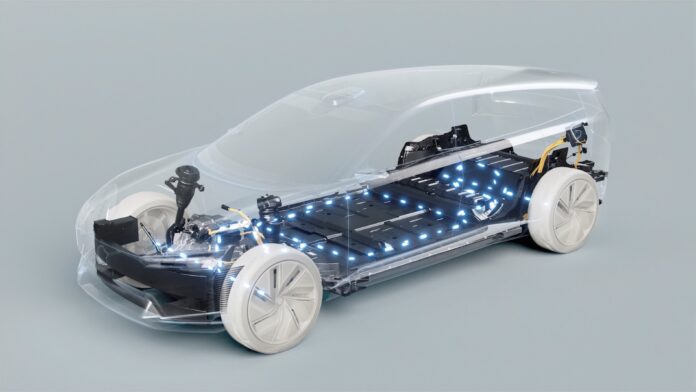

JR- Here is a thing that never gets spoken about. I come from a different background, not automotive. I am from the tech sector, I am manufacturing engineer and I did my masters in Supply Chain. When you build ICE cars you have huge complexity… you have a 1.2, a 1.6. a 2 litre engine, 4 cylinders, 6 cylinders… all the pistons have different sizes, all the piston rings, all the cylinders and cylinder heads and blocks… screws, nuts, bolts… everything is a different size. When you move to electric motors it’s a totally different scenario… a completely different supply chain. An e-motor (maybe in two sizes) and a battery and then to get different outputs for different vehicle segments you just add more modules or reduce them, you get torque “for free”. And that’s it.

So there is no reason why the price parity between ICE and EV should be pushed forward in terms of the calendar?

JR- We are there. Even in the case of our smaller car, in a more price sensitive segment: the EX30. We have stated that we will sell it for 35 000 dollars and we heard comments that we were crushing our profit margins, but that’s not true. Most OEM are very secretive about their BEV and ICE margins, but we were totally transparent. Cost of lithium may change the equation here and there, but we are at 9 percent BEV margin today and will improve it to 15 to 20 percent with the EX30. That´s not less than ICE margins, I assure you.

Can you prove it?

JR- That´s the same question we get from the markets. I tell you one thing: in seven months, when we present our Q2 results from 2024, you will see how many EX30 we sold and you will be able to confirm what the vehicle´s profit margin is. We will be the only guys close to the Tesla figures in that respect. And then we will prove that we were one the first among the heritage companies that have crossed the Rubicon and got to the other side with decent EV sales volumes and decent profit margins.